8/01/2024

Taxes

Investing in real estate is not only about finding the right property; it's also about understanding the tax implications that come with ownership...

Next Publications

8/01/2024

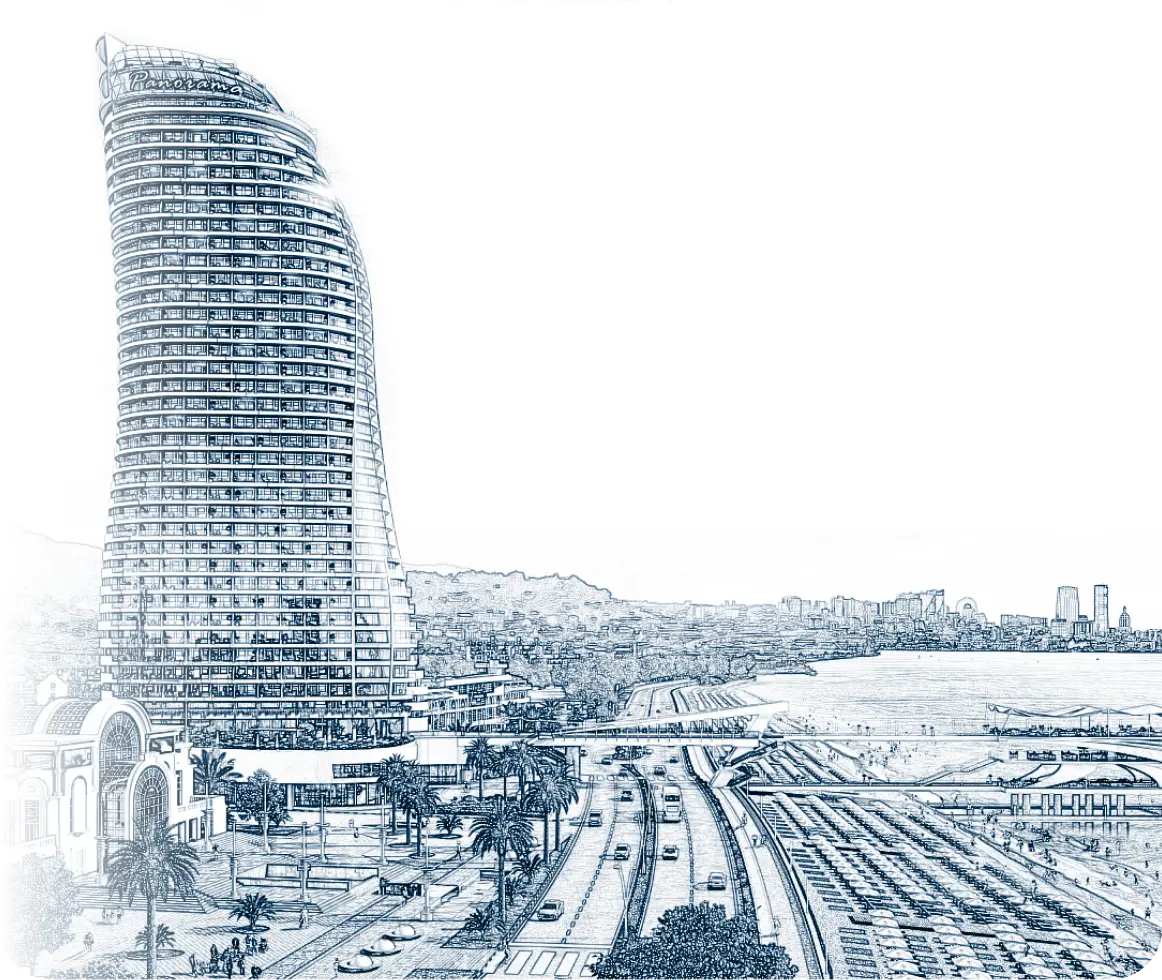

Investing in real estate, especially in emerging markets like Batumi, Georgia, can be a lucrative opportunity for both local and foreign investors.

8/01/2024

Investing in real estate is not only about finding the right property; it's also about understanding the tax implications that come with ownership...

8/01/2024

Investing in real estate is all about maximizing returns, and one crucial factor that directly impacts profitability is the occupancy rate...

8/01/2024

Batumi, nestled on the shores of the Black Sea, is a gem of a destination that attracts tourists from far and wide...

8/01/2024

When it comes to real estate investments, understanding the distinctions between an investment apartment and a residential apartment is important...